100+ Minutes with Rory McIlroy

+ Leadership Rules, Forecasting, Jamie Dimon Management Master Class

“External things are not the problem. It’s your assessment of them. Which you can erase right now.” — Marcus Aurelius

Sponsored By:

The Chase Sapphire Preferred is my favorite credit card for all purchases and is currently running the best ever 100,000 point bonus if you meet spend criteria. Highly recommend (only if you haven’t applied for 5+ cards in the last 24 months).*

Hey Coaches,

Here you go!

✍️ Articles

The Problem with Saying “Don’t Bring Me Problems, Bring Me Solutions”: Managers say "Don't bring me problems, bring me solutions" because they don't want a complaint culture. But encouraging your employees to speak up about tough issues helps them feel safe to bring up bad news earlier on — helping to avert crises down the line.

As Harvard Business School professor Frances Frei says, “Identifying problems can be a solo sport, but finding solutions rarely is.”

Fastenal's Foundation: Revisiting Bob Kierlin's Leadership Rules: Fastenal is a ~$45 billion company. The founder of the company talks through some of his 10 rules for leadership in the article (rules are shown below).

🎙️ Podcast

I Can Fly: #12 | Rory McIlroy | Four-Time Major Champion from Northern Ireland: This is a year old, but a great episode with the 2025 Masters Champion. [4/2/2024 - 102 minutes] Apple | Spotify | YouTube

"Just because you shot a good score doesn't make you the greatest person on earth and just because you shot a bad score doesn't make you a piece of shit."

💭 Miscellaneous

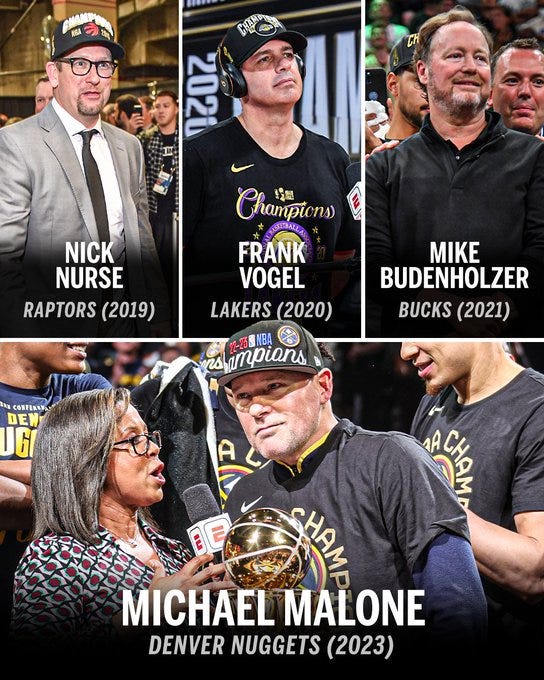

Four of the last six NBA coaches to win the Finals are no longer with the team they won with.

Investor Howard Marks on Forecasting (source)

One of the things I insist on is that even for someone who deals with the future via forecasts, a forecast isn’t enough. In addition to a forecast, you also need a good sense for the probability your forecast is correct, since not all forecasts are created equal. In this case, under these circumstances, it must be accepted that forecasts are even less likely to prove correct than usual.

Why? Primarily because of the vast number of unprecedented unknowns involved in the current matter, which has the potential to turn into the biggest economic development in our lifetimes. There’s no such thing as foreknowledge here, just complexity and uncertainty, and we must accept that as true. This means that if we insist on achieving certainty or even confidence as a precondition for action, we’ll be frozen into inaction. Or, I dare say, if we conclude we’ve reached decisions with certainty or confidence, we’ll probably be mistaken. We must make our decisions in the absence of those things.

But we also have to bear in mind that deciding not to act isn’t the opposite of acting; it’s an act in itself. The decision to not act – to leave a portfolio unchanged – should be scrutinized as critically as a decision to make changes

📺 Video

J.P. Morgan CEO Jamie Dimon held a “master class” focused on management lessons for 400 of the company’s top executives. The talk focuses on the need to nurture innovation, ambition and discipline while discouraging complacency, arrogance and bureaucracy.